How to register NTN online:

What is NTN:

E-Enrollment with FBR give you a National Tax Number (NTN) or Registration Number and password. In case of individuals, 13 digits Computerized National Identity Card (CNIC) will be used as National Tax Number (NTN).

Who can apply for NTN online?

All individual who are Pakistani citizen can apply online for e-enrollment to obtain National Tax Number. All companies and firms (AOP & LLP) needs to submit all the document to the relevant FBR office.

Procedure of NTN registration:

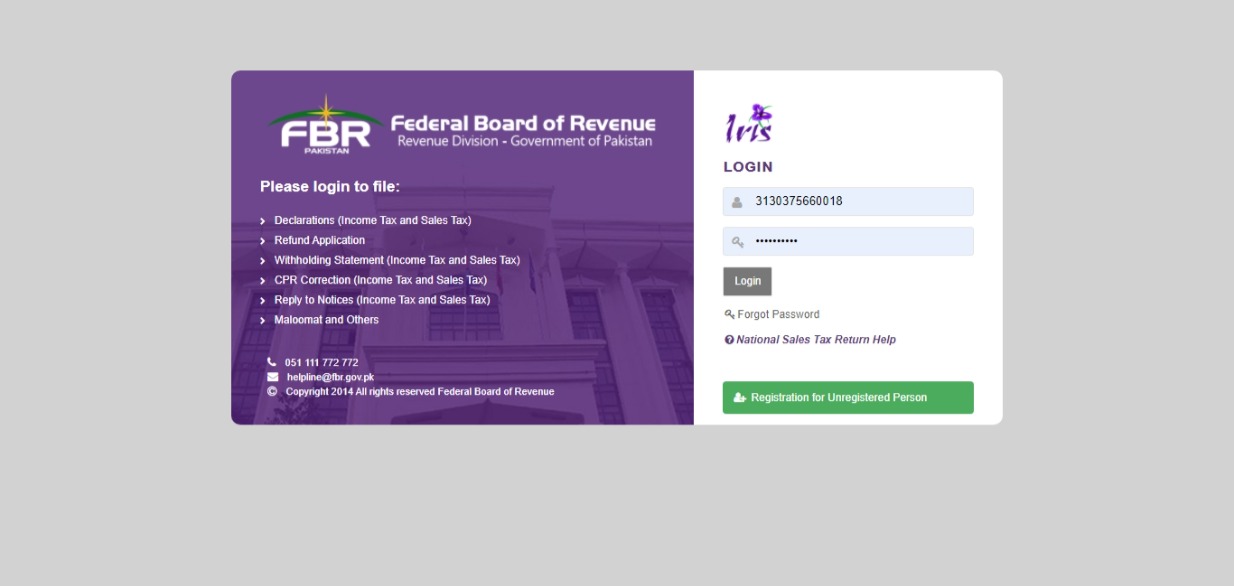

Applying for e-enrollment need to go FBR website by clicking on this link” Login-Tax Payer (fbr.gov.pk)” As shown in image this page will be open, just click on green box with heading “Registration for Unregistered Person.” A new page will be open for new registration as shown in diagram.

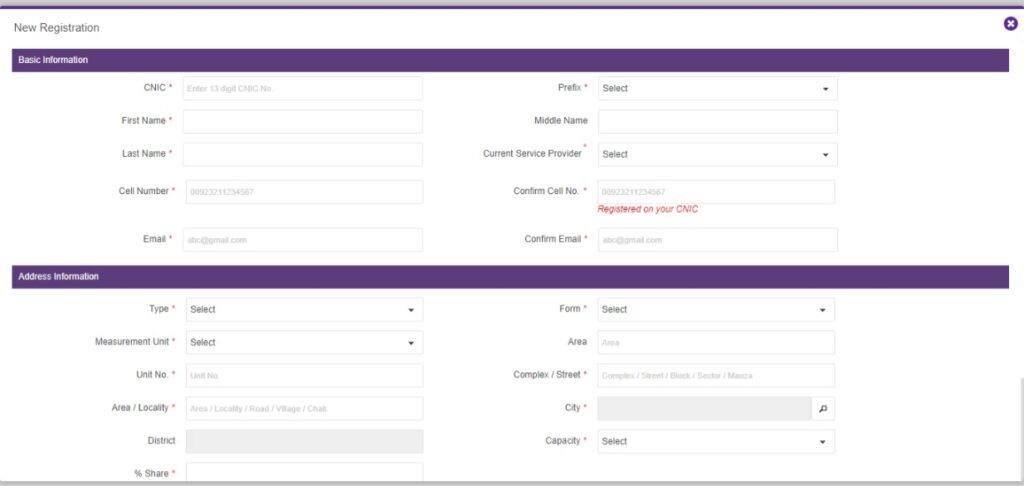

There are two sections, one is about basic information and other section is about address information

Here we will guide you step by step how to fil the form:

- CNIC: write the applicant CNIC card number that is provided by NADRA.

- Prefix: prefix is the personal title, there 4 options Mr., Mrs., Ms., and Dr. Married and unmarried men can use Mr, unmarried women will use Ms., a married women’s tile is Mrs. And a degree holders can select Dr. title.

- In third, fourth and fifth boxes write the first name, middle and last name. First part of the name and last is mandatory.

- The sixth box is about the service provider for the mobile phone or company name of the sim.

- In the 7thand 8th box needs to write the mobile number in this format 00923000111693.

- In the last two boxes needs to carefully write the email address, FBR will send OTP on mobile and email ID.

- In the first box of second section needs to select the type of property from the given list. Like commercial, residential, industrial etc, select the appreciated option for you.

- Once you select the type of the property then page will be update accordingly. In this box needs to select the form of property for example if you selected residential property in previous box then it will show the form of property like, house, villa, flat etc. Just choose the option accordingly of your property.

- In the third box of the second section needs to select the measurement unit of the property like Kanal, Marla or square yard whichever is related to you.

- 4thbox is about the area, just write the total area of your property in kanal/marla accordingly as per your last selection.

- Unit No: write there property number like house no, plot no, or flat no, of your property.

- Complex/Street: write the street number or plaza name or any housing complex.

- Area/Locality: write the area of your property. Suppose you are in the city of Rawalpindi and property is located DHA, then you have to write the DHA or it’s in Saddar then write saddar.

- City: write the name of your city

- District: write the name of your district in this box

- Capacity: from the select choose either you are owner of the property or its on lessee just choose as per your property.

- Share: write the share of the property you are providing the address. It can be from 1 to 100 percent.

- In the last box write the captcha as shown there and take care of case of alphabet.

- Click on the submit button, once you hit the submit page will be update and FBR send you OTP on mobile number and email id. Write the OTP and then click on verify. Once your OTP verified FBR will send you user ID and password for the IRIS account. First time portal automatically logged in after

- Now you can login to your FBR account by this link “Login-Tax Payer (fbr.gov.pk)”